A day after the PGA Tour and DP World Tour agreed to a for-profit merger with the financial backers of LIV Golf, the Tour could lose its tax-exempt non-profit status if this House bill passes.

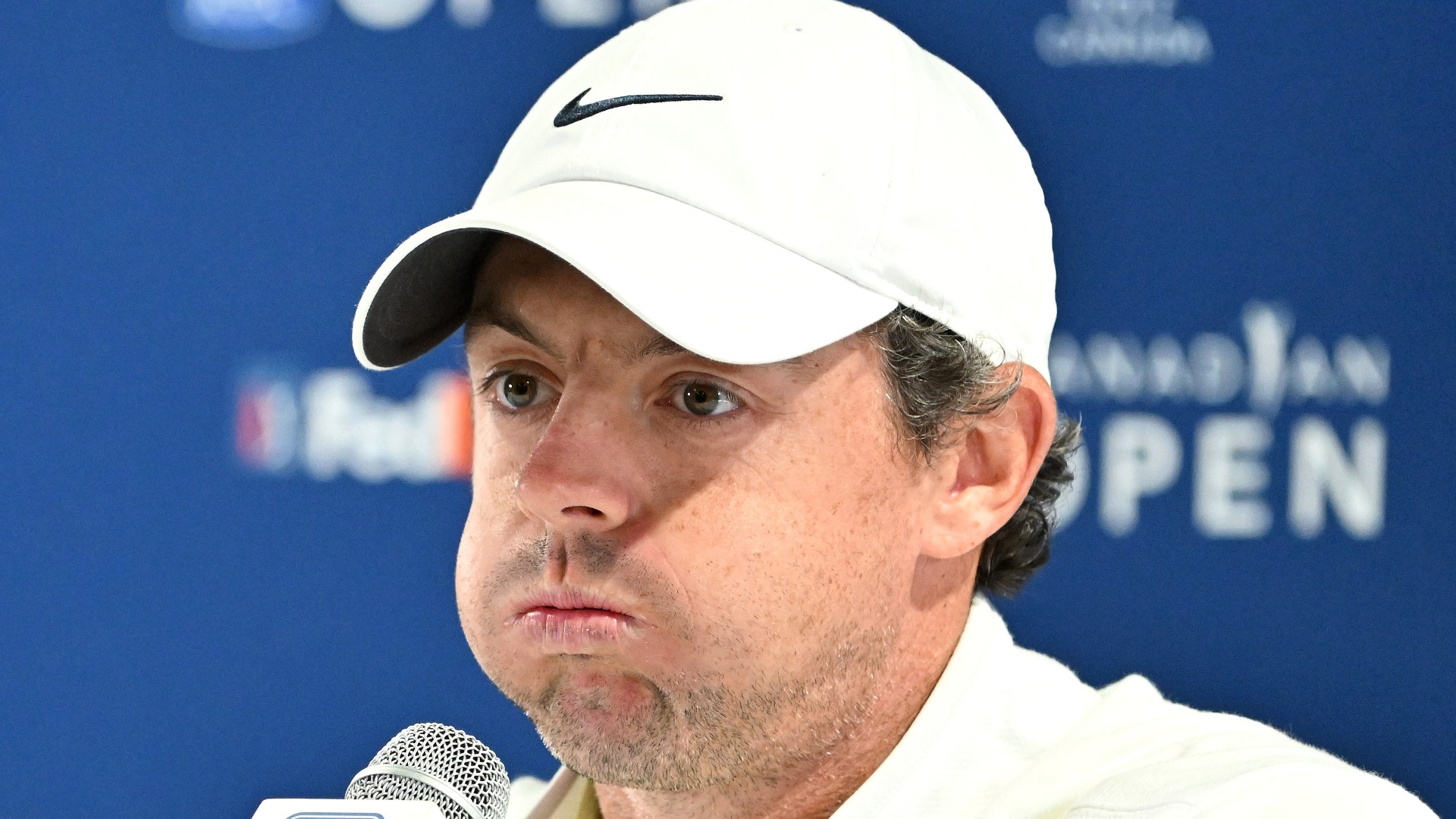

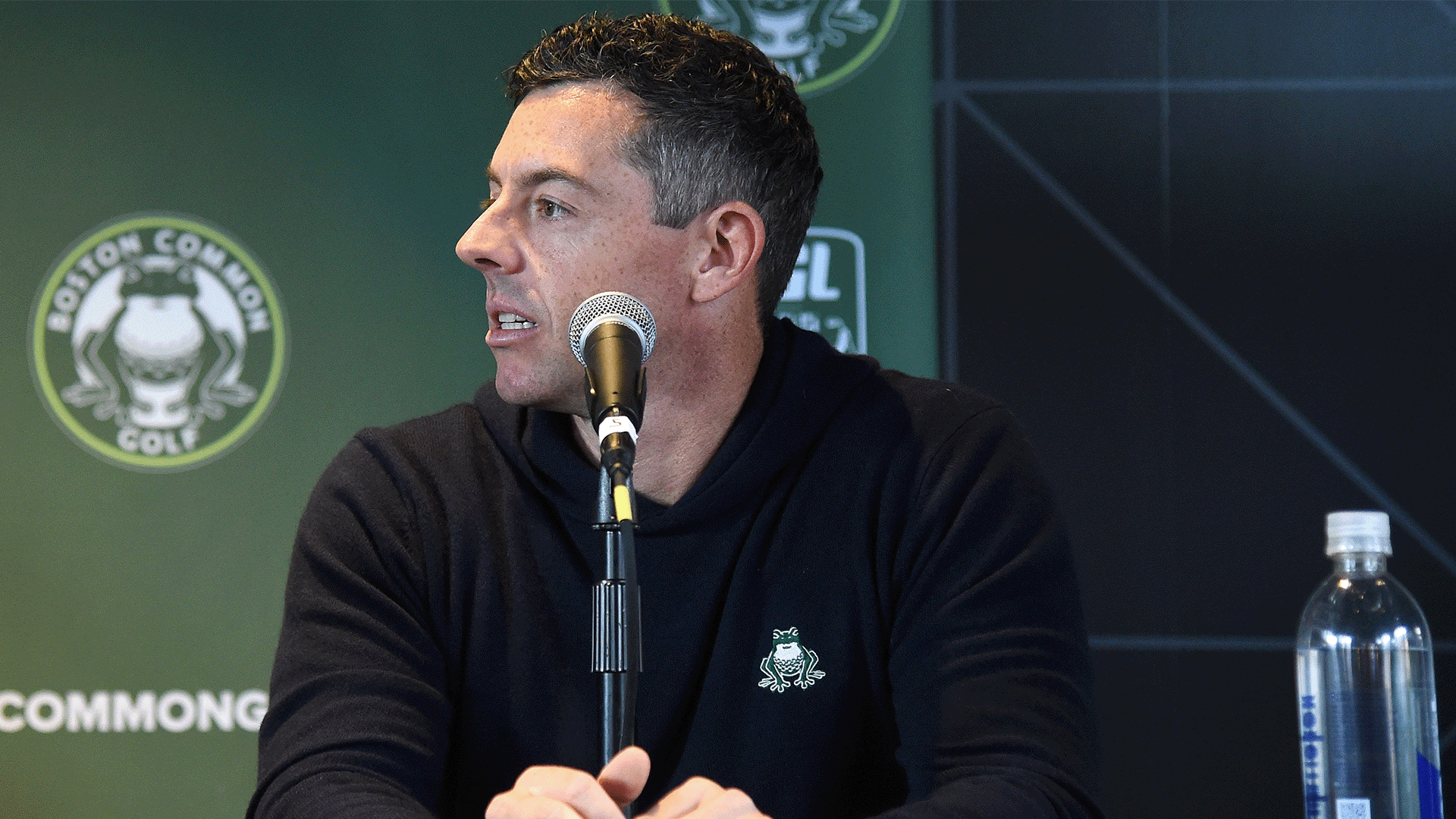

PGA Tour commissioner Jay Monahan kept many top players in the dark on this historic deal with Saudi Arabia's Public Investment Fund, which will be the sole investor in the merger and has right of first refusal on outside investors. There was no love lost from Rory McIlroy, but the sports world understood there were millions to be had in this potential deal -- regulators can strike it down based on antitrust grounds.

Monahan, who didn't offer a strong response for the outrage from families of 9/11 victims, was insistent the tour would retain its 501(c)(6) tax-exempt non-profit status when he called it "central fabric to who we are," per Yahoo Sports. The Tour's "commercial businesses and rights" would be moved to a new, yet-unnamed for-profit entity.

ESPN reported in 2013 that the Tour avoided paying $200 million in federal taxes, and the likely revenue increase with a partnership with the PIF would allow even more tax breaks.

Story continues below advertisement

That is why Calif. congressman John Garamendi introduced the "No Corporate Tax Exemption for Professional Sports Act" on Wednesday.

"The legislation would end the tax loophole that the PGA Tour and other professional sports leagues exploit to avoid paying any federal corporate income tax," a press release read. "These professional sports leagues each generate more than $100 million annually in corporate income, which would be taxable under the Garamendi bill. In 2015, the National Football League voluntarily stopped claiming exemption from the federal corporate income tax under an exemption originally intended only for amateur sports."

The NHL ceased filing as a not-for-profit after 2014, Major League Baseball opted out of its tax-exempt status in in 2008 and the NBA never sought an exemption. The NFL opting out of its tax-exempt entity did allow the league to not have to disclose the pay of its executives like commissioner Roger Goodell, but legislators and fans questioned whether sports league deserve tax breaks at all.

Story continues below advertisement

"Saudi Arabia cannot be allowed to sports wash its government's horrific human rights abuses and the 2018 murder of American-based journalist Jamal Khashoggi by taking over the PGA," Garamendi said in a press release. "PGA Tour Commissioner Jay Monahan should be ashamed of the blatant hypocrisy and about-face he and the rest of PGA's leadership demonstrated by allowing the sovereign wealth fund of a foreign government with an unconscionable human rights record to take over an iconic American sports league and avoid paying a penny in federal corporate income tax. This merger flies in the face of the PGA players who turned down hundred-million-dollar paydays from the Saudi-backed LIV to align themselves with the right side of history and human decency.

"The notion that the Saudi Sovereign Wealth Fund would pay zero dollars in taxes on their blood money and potentially billions of dollars in profits while countless American families pay their fair share while struggling to make ends meet is ludicrous. My commonsense legislation would right this wrong and bring some much-needed accountability to this matter."

Rep. Garamendi has not been the first to call out the PGA Tour's tax-exempt status. LIV Golf CEO Greg Norman called out Monahan for using the Tour's tax-exempt status to not pay golfers more. The issue was brought up in a tax-reform bill in 2018 but was taken out after lobbying from Jack Nicklaus and Davis Love III, per Golf Channel's Rex Hoggard.

Story continues below advertisement

Tiger Woods and McIlroy wanted the Tour to drop its tax-exempt status as a way to compete against LIV Golf while meeting with other top golfers, according to Alan Shipnuck. Woods has not commented on the agreed merger, as of Wednesday, But it's likely Monahan and the PGA Tour will continue to face scrutiny from the public.

Featured image via Jeff Romance / USA TODAY Sports Images